schedule c tax form 2020

Access IRS Tax Forms. Any overpayment shown on Form 1040-C will be refunded only.

2020 Schedule C Self Employed How To Report Ppp Received Page 2

Share E-Sign Instantly.

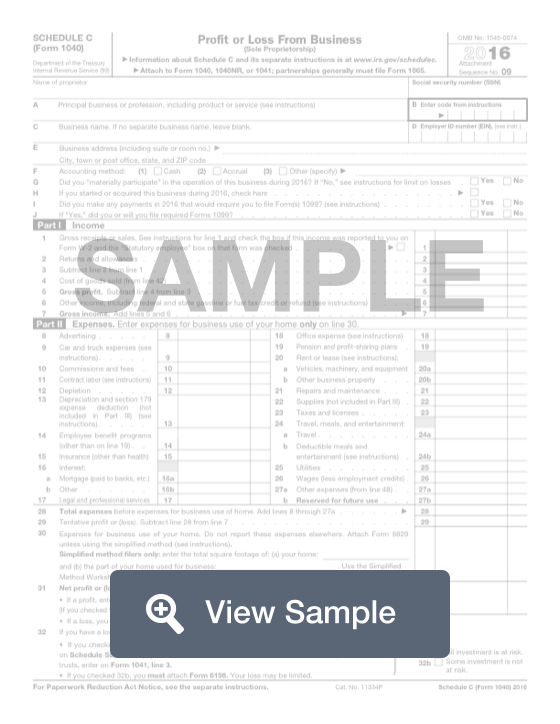

. Schedule E Form 1040 to report rental real estate and royalty income or loss that is not subject to self-employment tax. Shareholders Aggregate Foreign Earnings and Profits. This form is known as a Profit or Loss from Business form.

Include pictures crosses check and text boxes if needed. Ad Write A Form Schedule C With Our Premium Fillable Templates- Finish Print In Minutes. Click on the product number in each row to.

Fill in if you. Name of proprietor. PA-40 A -- 2020 PA Schedule A - Interest Income Form and Instructions PA-40 B -- 2020 PA Schedule B - Dividend Income Form and Instructions PA-40.

Tax Forms Calculator for Tax Year 2020. Select a category column heading in the drop down. Open the record with our advanced PDF editor.

26 rows Form 965 Schedule C US. Ad Register and Subscribe Now to work on your IRS 1040 - Schedule C more fillable forms. Fill in the details required in IRS 1040 - Schedule C using fillable fields.

Click on the product number. Complete Edit or Print Tax Forms Instantly. However the COVID-related Tax Relief.

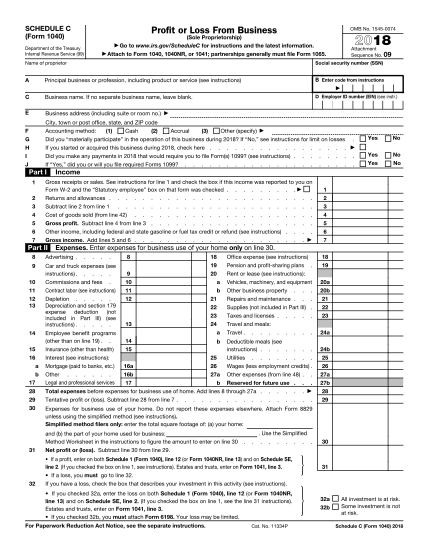

The resulting profit or loss is typically. 98 rows Prior Year Products. 2020 irs form 1040 schedule c instructionsContinueSchedule C also known as Form 1040 Profit and Loss is a yearend tax form used to report income or loss from an individual entrepreneur.

DCT-64 -- Corporation Tax Bulletin Number 123 - Subjectivity to Gross Receipts Taxes Article IX Mobile Telecommunications. Fill in if you made any payments in 2020 that would require you to file Forms 1099. A Schedule C is a supplemental form that will be used with a Form 1040.

Access IRS Tax Forms. 2020 Personal Income Tax Forms. Schedule E Form 1040 to report rental real estate and royalty income or loss that is not subject to self-employment tax.

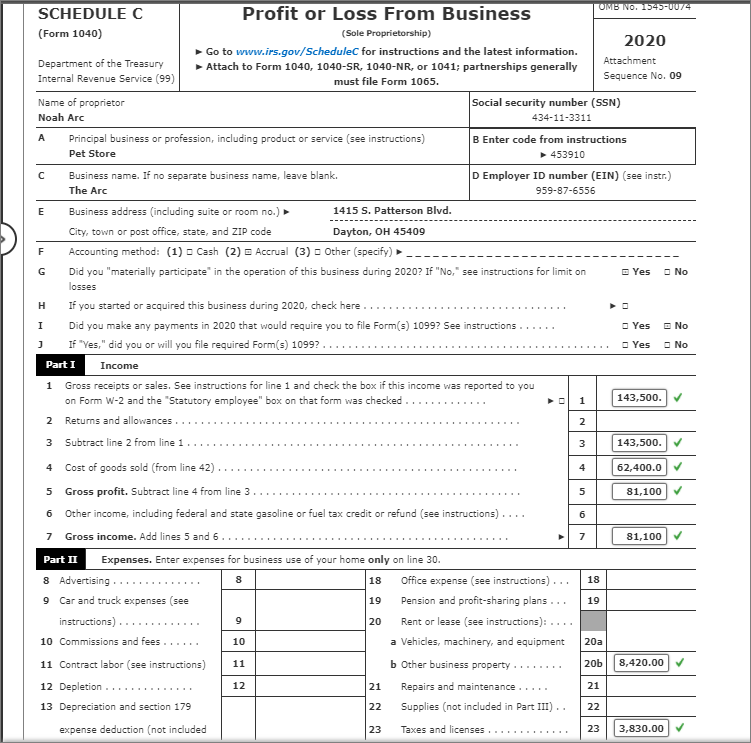

Ad Edit Sign or Email IRS 1040 SC More Fillable Forms Register and Subscribe Now. The first section of the Schedule C is reserved for your business information. Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor.

See Dual-status tax year later. January 1 - December 31 2020. Were going to review this in detail below.

Ad Edit Sign or Email IRS 1040 SC More Fillable Forms Register and Subscribe Now. Get Trusted Legal Forms. 2020 Tax Returns were able to.

Form 1040 1040-SR or 1040-NR line 3a Qualified dividends -- 06-APR-2021. It is used by the United States Internal Revenue Service for. Form 1040 due to the Taxpayer Certainty and.

Schedule F Form 1040 to report profit or loss from. A company that had a loss of 10 million in 2018 and a profit of 10 million in 2019 with a 30 tax rate would pay zero tax in 2018 and 3 million in 2019. Select a category column heading in the drop down.

Enter a term in the Find Box. Complete Edit or Print Tax Forms Instantly. Face masks and other personal protective equipment to prevent the spread of COVID-19 are tax deductible.

Americas 1 tax preparation provider. Any tax you pay with Form 1040-C counts as a credit against tax on your final return. 9 rows Forms and Instructions PDF Enter a term in the Find Box.

Massachusetts Profit or Loss from Business. IRS Schedule C Profit or Loss from Business is a tax form you file with your Form 1040 to report income and expenses for your business. Schedule F Form 1040 to report profit or loss from farming.

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor. IRS Income Tax Forms Schedules and Publications for Tax Year 2020. Usually people who file a Schedule C Tax Form will also have to file a Schedule SE Tax Form.

PA-8453 C -- 2020 PA Corporate Net Income Tax Declaration for. You may also need Form 4562 to claim depreciation or Form 8829 to. Its total profit before tax.

As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Ad Register and Subscribe Now to work on your IRS 1040 - Schedule C more fillable forms.

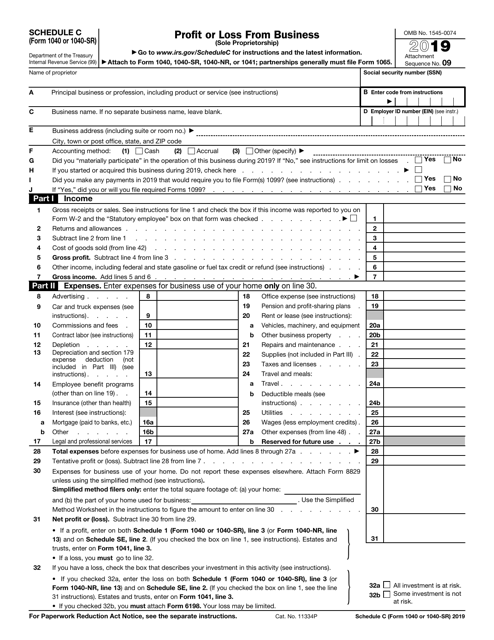

1040 Instructions 2019 Schedule C

Irs Form 1040 1040 Sr Schedule C Download Fillable Pdf Or Fill Online Profit Or Loss From Business Sole Proprietorship 2019 Templateroller

3 Schedule C 1040 Form Free To Edit Download Print Cocodoc

A S E F G H E No Oms No 1545 0074 Schedule C Profit Chegg Com

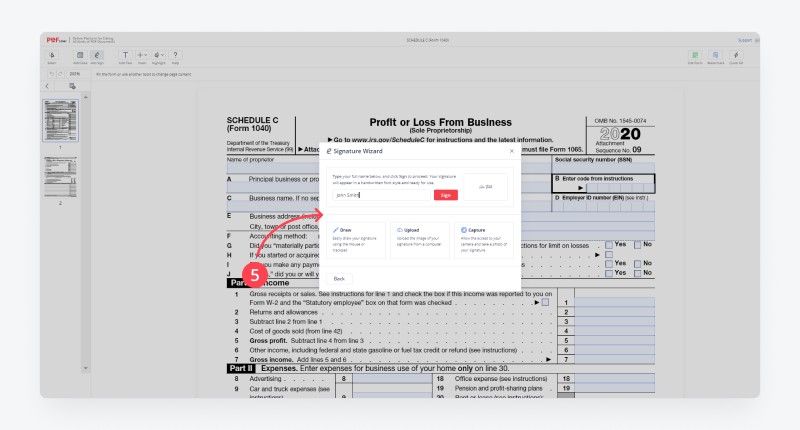

How To Sign Schedule C Form 1040 Complete Guide

Sch C Car Truck Expenses 637 Income Tax 2020 Youtube

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet Irs Forms Tax Forms Irs Tax Forms

Schedule C Worksheet Fill Out Sign Online Dochub

Do You Have To Report A Ppp Loan On Your Taxes

What Is A Schedule C Tax Form H R Block

What Is Tax Form 1040 Schedule C The Dough Roller

/SchedF-0ace017c310b43189a3050710d298e4c.jpg)

Schedule F Form Profit Or Loss From Farming Definition

Schedule C Form 1040 Free Fillable Form Pdf Sample Formswift

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business

2020 2022 Form Pa Pa 40 C Fill Online Printable Fillable Blank Pdffiller

Yet Another New 1040 Form White Coat Investor

Schedule C Form 1040 2020 2021 Instructions How To Prepare Sched C Full Guide Taxes S1 E16 Youtube